One thing that Warren Buffett's name has come to be interchangeable with is "long-term investing." After all, the Berkshire Hathaway (BRK.A) CEO and Chairman is famous for saying that his "favorite holding period is forever," and his pedigree includes investments in American Express (AXP) and The Washington Post (WPO) that he made over forty years ago and still holds to this day. But I think that it's important to understand these investments within the larger context of Buffett's investment story.

When Warren Buffett first graduated from the University of Nebraska, he moved back into his parents' house and launched an investment partnership with the capital that he raised from his parents, other family members, friends of the family, and local doctors. Buffett would calculate the intrinsic value of a company, find stocks that were trading very low in relation to the intrinsic value, wait for the price gain to be realized, sell the stock, and then do it all over again. Wash. Rinse. Repeat. This was Buffett's methodology during the early years of the partnership and the first few years of when he began running Berkshire Hathaway that enabled him to earn 25-35% annual returns.

The true "proof" of Buffett's buy-and-hold forever investments generally pertains to the operating companies that Buffett bought during the 1960s and 1970s and owns to this day. For instance, between 1970 and 1987, Buffett added these operating companies to the Berkshire umbrella: Buffalo News, Fechheimer, Kirby, Nebraska Furniture Mart, Scott Fetzer Manufacturing Group, See's Candies, Wesco (partial subsidiary), and The World Book. In particular, See's Candies and Nebraska Furniture Mart have supplied Buffett with quarterly profits for decades which he can then in turn put towards new investments which can generate profits of their own for Berkshire shareholders. The operating companies owned by Berkshire probably provide the best testament to Buffett's buy-and-hold approach, but of course, this does investors looking for ideas little good since they only way they can own See's Candies would be indirectly through Berkshire Hathaway.

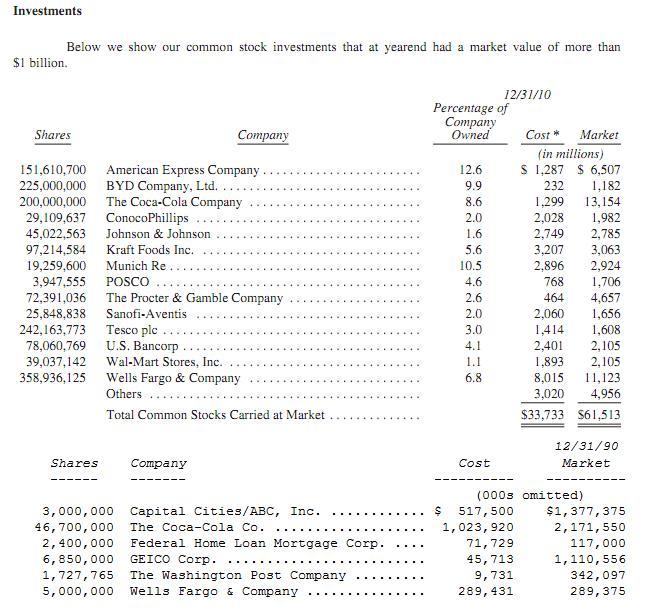

I've included a chart that compares Berkshire's investment portfolio between 1990 and 2010 as noted in Buffett's Annual Letter to Shareholders of Berkshire Hathaway. Buffett still owns his stake in The Washington Post and Coca-Cola (KO) , bought GEICO outright, and added to his position in Wells Fargo (WFC). He sold part of his American Express holdings to the point that it did not qualify for top-tier status in the 1990 Letter to Shareholders, because the position was not large enough for Buffett to consider it material knowledge for investors.

So what is the takeaway lesson in understanding the relationship between Buffett and his "buy-and-hold forever" quote? Well, in the early years, Buffett did not hesitate to sell investments if he thought that there was a greater opportunity cost elsewhere. Most likely, he probably followed Benjamin Graham's advice in regard to selling: Only sell to buy a security that is a third cheaper than the stock you currently own. That way, you allow room for frictional expenses (trading fees) and taxes which can eat up your investment, while allowing yourself a margin of safety as you switch investments. For the first half of Buffett's investing career, he did not hesitate to sell a stock once it reached its intrinsic value, and if he believed that the company offered a durable competitive advantage that would generate cash for the long haul, then he would purchase the company outright, such as in the case of See's Candies and GEICO Insurance.

It was not until the later part of Buffett's career-once Berkshire had grown so large that the possibility of moving into and out of large investments became logistically infeasible-that he began to add publicly traded securities to the "permanent" section of his portfolio. Looking at the holdings over $10 billion (companies like Coke, Wells Fargo, and IBM), Buffett most likely will hold them for quite some time since they would be difficult to subtract from the investment portfolio (and plus, Buffett would have to think that he could do something significantly better with the cash, which is unlikely).

Of course, none of this is meant to knock long-term investing, but rather, to get a more nuanced view of what Buffett's record reveals in the buy-and-hold department. At the time of the last shareholder letter, Buffett's $1.3 billion investment turned into $13 billion, and the $1.2 billion investment in American Express has turned into $6.5 billion. And most importantly, Buffett does not reinvest the dividends in these companies. For instance, Coca-Cola currently pays Berkshire an annual dividend in the hundreds of millions of dollars that does not accrue towards the performance of Coca-Cola on Berkshire's balance sheet, yet it has been a significant source of funds for Buffett's subsequent investments. Buffett has done quite well with his very long-term holdings, but to think that tells the entirety of the Berkshire story would ignore the early years and some of the smaller investments in the portfolio which are regarded as exchangeable upon reaching intrinsic value.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Source: http://seekingalpha.com/article/315898-the-truth-about-warren-buffett-and-forever-investing

amy schumer ascii art ascii art andrew mason once in a blue moon gwar guitarist gwar guitarist

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.